Explore ideas, tips guide and info Matti Melesa

2025 Tax Brackets Chart. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. If income thresholds for social security had been adjusted for inflation like federal tax brackets, the individual filing status level of $25,000 would be over $75,250,.

There are seven federal income tax rates and brackets in 2025 and 2025: For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600.

Federal Withholding Tables 2025 Federal Tax, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

How To Compare Tax Brackets 2025 With Previous Years Fancy Jaynell, The federal income tax has seven tax rates in. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Irs 2025 Standard Deductions And Tax Brackets Danit Elenore, How many tax brackets are there? There are seven tax brackets for most ordinary income for the 2025 tax year:

20232024 Tax Brackets and Federal Tax Rates NerdWallet, Knowing your federal tax bracket is essential, as it determines your federal. The federal income tax has seven tax rates in.

Tax Rates 2025 To 2025 2025 Printable Calendar, Irs tax withholding estimator updated for 2025. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the.

Tax rates for the 2025 year of assessment Just One Lap, The federal income tax has seven tax rates in. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

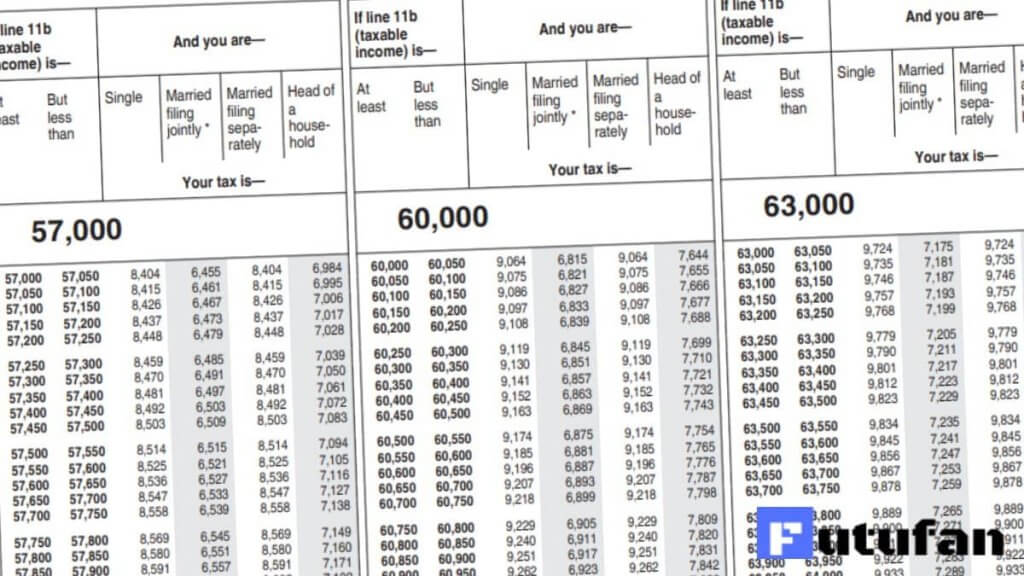

IRS Tax Tables 2025 2025, These rates apply to your taxable. See the tax rates for the 2025 tax year.

What IRMAA bracket estimate are you using for 2025?, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Employees and payees may now use the irs tax withholding estimator, available at irs.gov/w4app, when.

Tax Brackets 2025 What I Need To Know. Jinny Lurline, For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600. The top marginal tax rate in tax year 2025, will remain at 37% for single individuals with incomes greater than $609,350.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, 10%, 12%, 22%, 24%, 32%, 35% and 37%. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the.